Bankruptcy On A Budget: How To File Without Breaking The Bank

A Guide To Filing Bankruptcy on A Budget

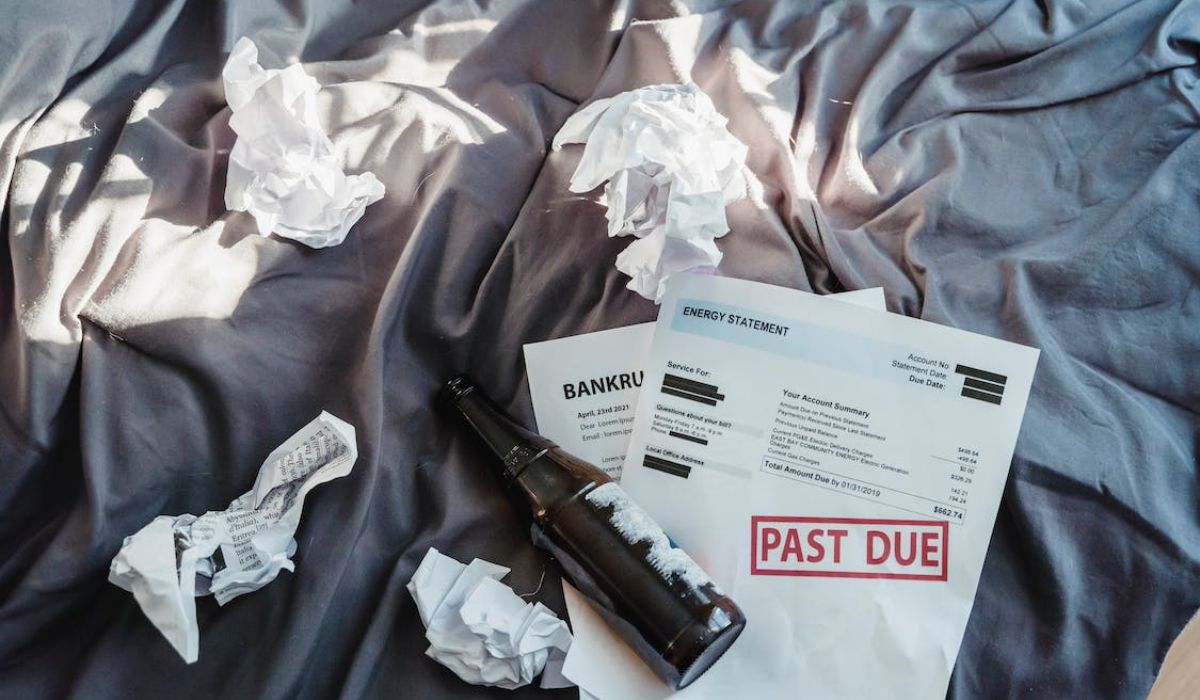

In this economy, everything becomes challenging. Providing the things you want and need at the same time has become difficult lately. American consumers end up filing for bankruptcy at some point, and this is challenging. They need to look for a bankruptcy attorney they can afford.

A bad financial situation will be hard to get out of. If you want to file for bankruptcy, our team is here. Berardi and Associates, LLC will help you manage and lessen your stress. If you are drowning in debt, you do not want to add more stress to that, right? It can be panic inducing to hear the telephone ring or when a creditor keeps asking for money. Opening the mail fills you with dread because of the bills that are certain to be contained within. Our firm is available to help.You can contact us for any questions you have. You can call us at (708) 942-8030 or email us to assist you better. To help you more, you can read our Frequently Asked Questions (FAQs) page. Get your free consultation from us.

What Is Bankruptcy?

Bankruptcy is a legal process that allows individuals to receive debt relief. This is an opportunity to restructure their debts. They can make payments with a schedule to follow rather than feeling as though they must pay it all at once.

If someone who has debt files for bankruptcy, they are free from extra collection efforts. Their creditor can only ask for payment once the filing is complete and successful. The court will decide the amount of what an individual or business must repay. The court looks at all possible aspects before declaring bankruptcy and will determine what repayment plan will work best for the individual.

This can be an intimidating option for many, but if you are struggling with a huge debt, this will benefit you. However, there are also consequences that come with it. That is where Berardi and Associates, LLC, can make the process easier and ensure you know your rights and responsibilities when filing for bankruptcy.

Preparing To File For Bankruptcy

If you are considering filing for bankruptcy, you must prepare. You must gather critical information before proceeding to the next step. Here are some important considerations as you prepare to file:

Gather The Financial Documents You Need

Before you proceed with the filing, your financial documents should be ready first. Prepare copies of your tax returns and statements from creditors. You should include anything related to your debt or income.

Learn The Different Types Of Bankruptcy

There are different types of bankruptcy. Each has its own set of qualifications. This is why doing research is also vital to the process. You need to know what fits your circumstances best . You can view Chapters 7, 11, or 13 to know what type of bankruptcy you should file for. Nobody wants to waste time filing for the wrong bankruptcy and ending up with nothing. The United States Bankruptcy Court in Illinois has a help desk available over the phone. You can call them at (312) 229-6344.

Knowing Your Budget

This is a problem for most debtors. Filing for bankruptcy is already a daunting task. Then, there is the added challenge of looking for a bankruptcy attorney who understands their situation. You must be aware that fees come with filing for bankruptcy. There will be court fees and attorney fees you need to prepare for. Take this into consideration when creating a budget for your case. You can always search bankruptcy lawyers near me to know how much it takes to file a claim. Doing this will help you be better prepared when you do reach out to an attorney. This will help you avoid paying extra costs that may arise during filing.

Berardi Law Office offers a free consultation. Prepare a budget and talk it out with us. Our team will help you prepare what you need as we go through the process.

Choose The Best Attorney

This is crucial for most debtors. Getting the best attorney declare bankruptcy office who will help them best. It is possible to declare bankruptcy without an attorney, but having legal representation makes it more accessible. You do not need to jump through hoops to finish the filing. An attorney who knows their way around will make the process smoother.

Consulting with a lawyer will give you more knowledge about the case. They have experience and are familiar with the local laws and regulations. If you want the best outcome for your case, hire an attorney to help you. Call Berardi Law Office today.

Filing For Bankruptcy On A Budget

You now understand why hiring an attorney for this process is essential. What should be your next step? Choosing a lawyer who will represent you plays a huge role in the process. But nobody wants to break a bank that is already broken. It becomes a challenge for most debtors to find an attorney to represent them. You should know the essential traits you must consider when hiring an attorney.

Years Of Experience

It is crucial to hire a lawyer with years of experience. Look for someone who has years of experience dealing with bankruptcies. You can expect that they know and will share many things about the case. This will help you understand your situation better. They will teach you the right things to do to increase your chances of being successful.

Attorneys Mark Berardi and Andrew Acosta a combined two decades of experience in practice areas including bankruptcy to best serve you. Their backgrounds ensure a smooth transaction for every client who comes to them. Get your free consultation from us, or contact Berardi And Associates, LLC to help you ensure the best outcome during your bankruptcy.

Compassionate

Finding an attorney who understands you can seem impossible. There is more to a good lawyer than knowing their field. Clients look for someone who can connect with them on a personal level. The right lawyer for this legal process should know how to care and support a client going through such a difficult time. Bankruptcy is no easy decision. Attorneys Berardi and Costa know this and hold their clients’ well-being as a top priority.

Has Good Knowledge In The Field

A reasonable bankruptcy attorney should have a thorough comprehension of finance and tax law. An attorney who understands these laws best can guide their clients on what to do. Your attorney must keep you informed of the consequences you may encounter. Some unavoidable problems will arise. A good lawyer will prepare you, saving you both time and money.

The Benefits Of Hiring An Attorney When Filing For Bankruptcy

Less Stress

For a smoother process, hire an attorney. They will share information and insight about your case to help you. When you hire an attorney, the task is not all on your shoulder.

Managing debt is already stressful. When you have an attorney, creditors will not keep harassing you. Attorneys can help you restructure your financial situation. Trust Berardi And Associates, LLC, to help you regain control of your economic life.

Improving Your Credit Score

This is a long-term benefit when you file for bankruptcy. Over time, your credit score improves as collection agencies need to close their accounts with you. This will show fewer items on your credit report. This will leave a good impression on future lenders. How they view you as a customer will improve if you have fewer debts on your credit report.

A Fresh Start For You

Who does not want new beginnings? Take this as an opportunity for a fresh start. You can manage your finances better than before. Hiring an attorney helps you tackle existing debts without paying any penalties.

Hiring an attorney can be a lot of work, but it is much harder to handle things alone. Take the stress off of you by getting help from the experts. For bankruptcy cases, contact Berardi And Associates, LLC.

Get your free consultation from the best attorneys we have in our firm. With the decades of experience we have, you can be sure that your filing does not go to waste. We pay attention to our client’s needs, and we listen. Our hours of operation are from Monday to Friday, from 9 a.m. to 5 p.m. For any questions, you can always send us an email. You can also call us at (815) 485-0830.

Berardi And Associates Offer The Following Services:

- Bankruptcy

- Business Law

- Estate Planning

- Personal Injury

- Real Estate Law

- Traffic Tickets

OTHER ARTICLES WE’VE HAND-PICKED FOR YOU:

- Thinking of Filing Bankruptcy? (13 Things To Consider)

- Should You Create An Estate Plan? (Hire An Estate Planning Attorney)

- Why Should You Hire A Real Estate Attorney 2021

Frequently Asked Questions

What Cannot Be Erased When You File For Bankruptcy?

Alimony and child support. Certain unpaid taxes, such as tax liens. Some federal, state, and local taxes, on the other hand, may be dischargeable if they are several years old. Debts for causing willful and malicious harm to another person or property.

Which Of The Following Is A Benefit Of Declaring Bankruptcy?

Filing for bankruptcy begins the process of rebuilding your credit. After receiving your discharge or beginning your repayment period, you can begin improving your credit right away. Some creditors find that their credit score improves after filing because they have a much lower debt-to-income ratio.

When you file for bankruptcy, the court may grant you a discharge, which will relieve you of the obligation to repay certain creditors. As previously stated, your creditors are prohibited from contacting you or attempting to collect the debt in any way once it has been discharged.

Can A Regular Person Declare For Bankruptcy?

Because of its complexity, Chapter 11 bankruptcy is usually reserved for corporations, but individuals can also file. The debtor usually keeps their assets and continues to run their business while working out a repayment plan with their creditors.

Can I Declare Bankruptcy If I Have No Assets?

Can You Declare Bankruptcy If You Have No Assets? Yes, even if you don’t have a lot of assets or property, you can still liquidate them in Chapter 7 bankruptcy. Your bankruptcy trustee will have to declare a no-asset bankruptcy, which means that your creditors will be unable to make claims against your property or assets in order to pay your debts.

Does Declaring Bankruptcy Discharge All Debts?

Filing for Chapter 13 bankruptcy stops all foreclosures, repossessions, and creditor harassment, and it completely wipes out most of your debt within three to five years. In many cases, under this chapter of the bankruptcy code, you will only be required to repay a small percentage of your debt.